50+ S Corp Late Filing Penalty Abatement Letter Sample

In response to the unique aspects of the pandemic the AICPA has created a custom penalty abatement letter for members to use as a starting point for relief. The first and probably most obvious circumstances warranting penalty abatement are death serious illness or unavoidable absence of a taxpayer or a taxpayers immediate family member.

Pdf The Demand For Public Transport A Practical Guide

John Doe 123 ABC Street San Diego CA 92109 SSN.

50+ s corp late filing penalty abatement letter sample. For some reason they had their preparer file their Corporate returns for 2011 and 2012 about a year past the deadline for each return. To Whom it May Concern. All partners timely filed their form 1040 for 2008 and fully reported their shares of income deductions and credits on their timely filed returns.

Here is a simplified IRS letter template that you can use when writing to the IRS. Assessed at 200 per shareholder per month. The reason why I _____pick one Paid late.

The taxpayer files a penalty non-assertion request along with their official return asking the Internal Revenue Service not to levy a penalty. Request for Penalty Abatement under Reasonable Cause. Was because _____ pick one.

Two partners 12 months late filingpenalty 4920 has been available since 1984 and provides automatic penalty abatement. Summary 2012-55 61412 considering the scope of the reasonable cause language to the Code Sec. Call 800 829-1040 and get an IRS agent on the line.

Your Name Your Address Your Social Security Number MMM DD YYYY Dear SirMadam. I am writing to request an abatement of penalties in the amount of 367367 as assessed in the enclosed notice that is dated 79XX. Factors are your response to a partnership late filing penalty letter from the IRS.

Request for Penalty Abatement. Immediate family member refers to a taxpayers spouse child parent brother sister grandparent grandchild step-parent step-child step-brother or step-sister. The template is available free to AICPA members.

But now they have an IRS letter with a substantial late filing S Corp penalty. S Corporation Late Filing Penalty Abatement. This template for a Penalty abatement letter can serve as a guide for taxpayers the have no idea how to proceed with their Penalty abatement letter.

The first way is to apply before the penalty is ever assessed. Please advise of the abatement. The company writes a penalty abatement letter.

Say I would like to request a first time penalty abatement based on my prior compliance for tax year _____ insert appropriate year. The agent will run a computer search over the three prior tax years to see if you have had any tax issues. Request for Penalty Abatement.

Practitioner requests that the penalty abatement provision in Revenue Procedure 84-35 that waives penalties for late filing for small partnerships fewer than 10 partners also apply to S corporations with 10 or fewer members. Your partnership or S corp can get a failure to file penalty if you file too late. 6699 penalty for late filing of an S corporation return the Tax Court determined that the failure to timely file a 2008 1120-S tax return was due to reasonable cause not subject to penalty.

The AICPA has a template for practitioners to use to request a reasonable-cause penalty abatement on behalf of their clients. They filed their Form 1120 S by the March 15 deadline or filed a Form 7004 Automatic Extension Request. IRS Reasonable Cause Letter Sample.

The return was filed in July and the Service assigned a penalty for the late filing IRC Section 6699 Insofar as I know the client has never been penalized in the past for issues related to. For a return where no tax is due the failure to file late-filing penalty is assessed for each month or part of a month that the return is late or incomplete up to a maximum of 12 months. The amount of the penalty is 200 for 2017 returns multiplied by the number of shareholderspartners in the S corporationpartnership during any part of the tax year.

They even have a certified mail receipt to prove it. IMRS 10-0001240 Late Filing Fees for Small Partnerships. Its an example of how your letter should look like.

Just follow these steps. Please be advised that XYZ represents the above referenced taxpayer taxpayers name hereinafter referred to as Taxpayer. The 2011 penalty is 4680 and the 2012 penalty is 3510.

The template is available free to AICPA members. Internal Revenue Service use the address provided in your tax bill Re. Please waive the proposed penalty under Revenue Procedure 84-35 as the above requirements have been met.

A request for an extension to file for the client was inadvertently missed this past March. We are writing to request that her penalty for filing a return after the due date and paying late together with interest are abated for her 2018 tax year. 2013 has not been filed.

Thats the story faced by thousands of Realtors and other small businesses who operate as S Corporations this year. Regarding S Corp Late Filing Penalty Excused IRC 6699 Ensyc Technologies v. Sample Penalty Abatement Letter.

Failed to report income. The second method is later in the process when the IRS has already levied the penalty. Then penalty is 195 per stockholder per month for each month that the return was late.

Penalty abatement Coordinator Internal Revenue Service Complete the address as stated on your tax penalty notice Re.

What Does An Engagement Letter Include

3 2 Letter Of Submittal Virginia Department Of Transportation

Tax Analyst Resume Samples Velvet Jobs

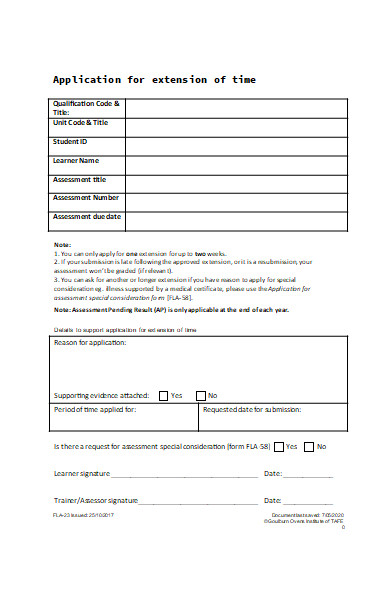

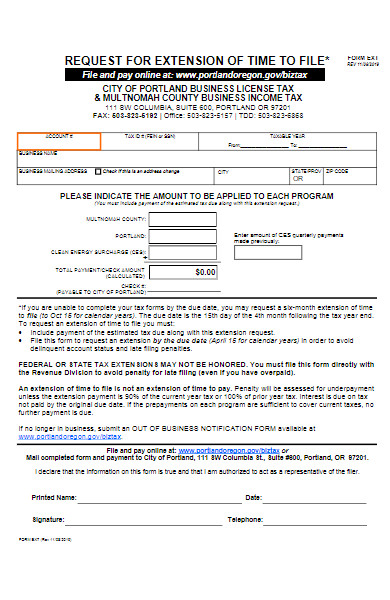

Free 50 Extension Forms In Pdf Ms Word

50 Sample Law School Personal Statements Harvard Law School By Geoff Cook Issuu

Free 50 Extension Forms In Pdf Ms Word

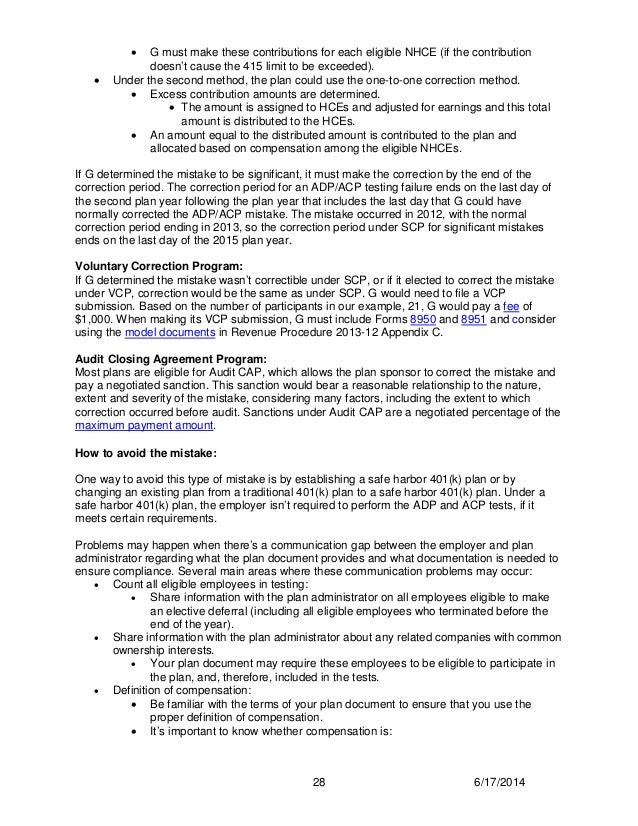

401k Mistakes Irs Updated 401k Fix It Guide

Pdf Tax Morale And Its Effect On Taxpayers Compliance To Tax Policies Of The Nigerian Government

401k Mistakes Irs Updated 401k Fix It Guide

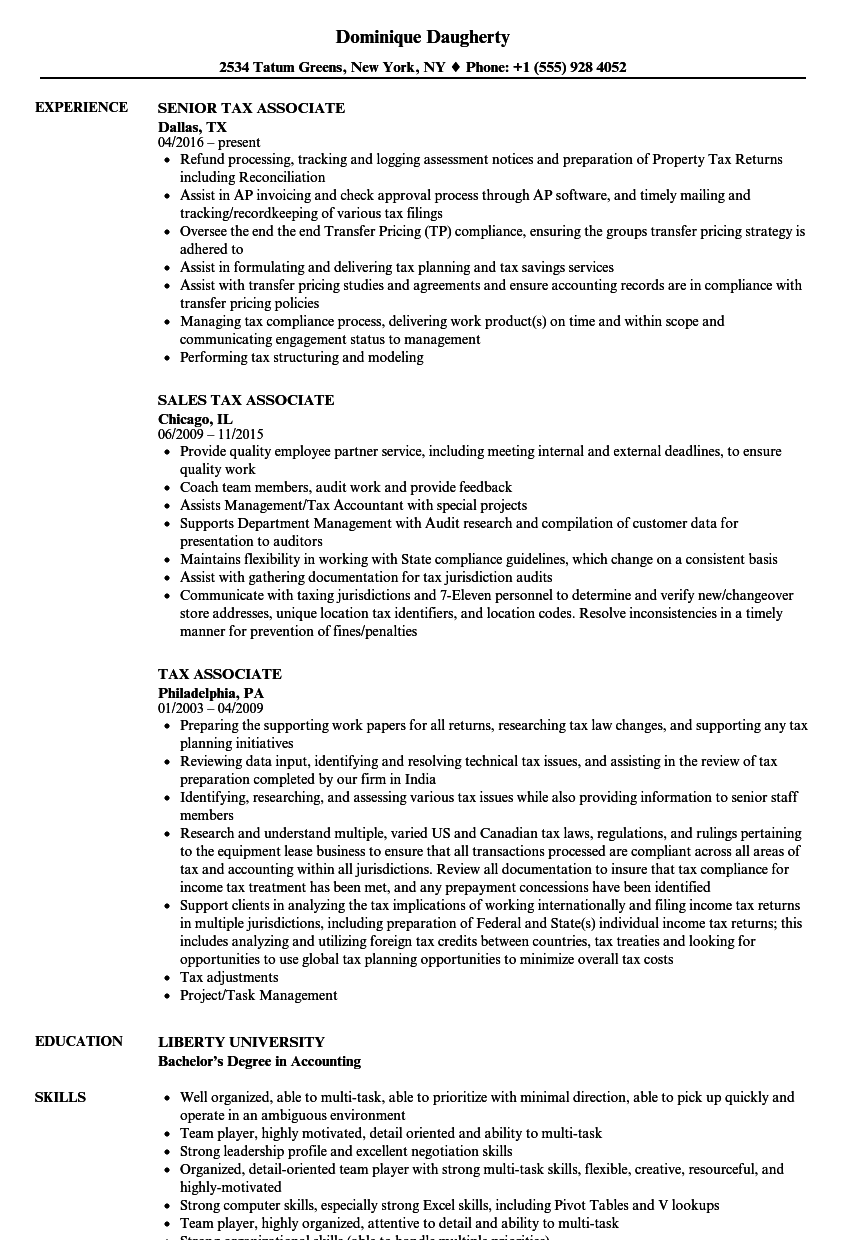

Tax Associate Resume Samples Velvet Jobs

Target Score Second Edition By Cambridge University Press Issuu

Free 50 Extension Forms In Pdf Ms Word

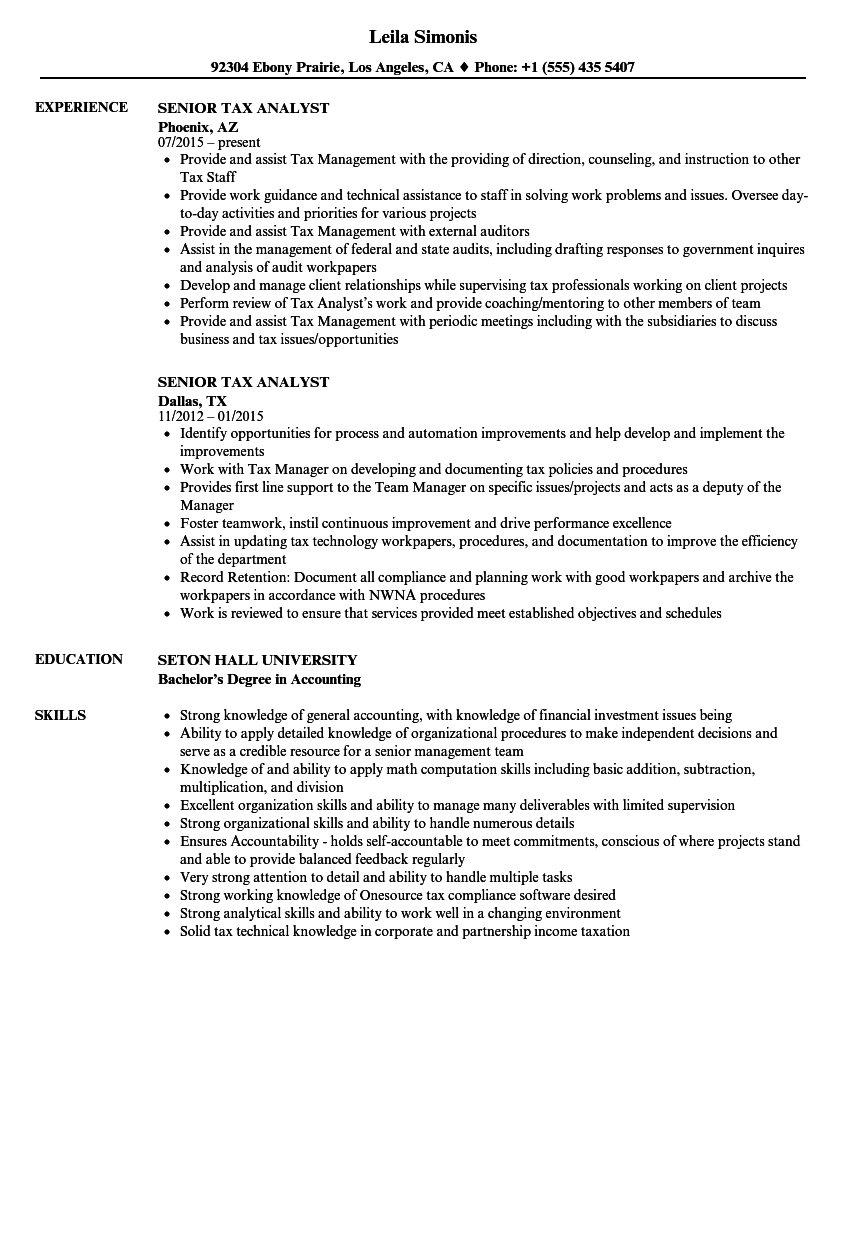

Senior Tax Analyst Resume Samples Velvet Jobs

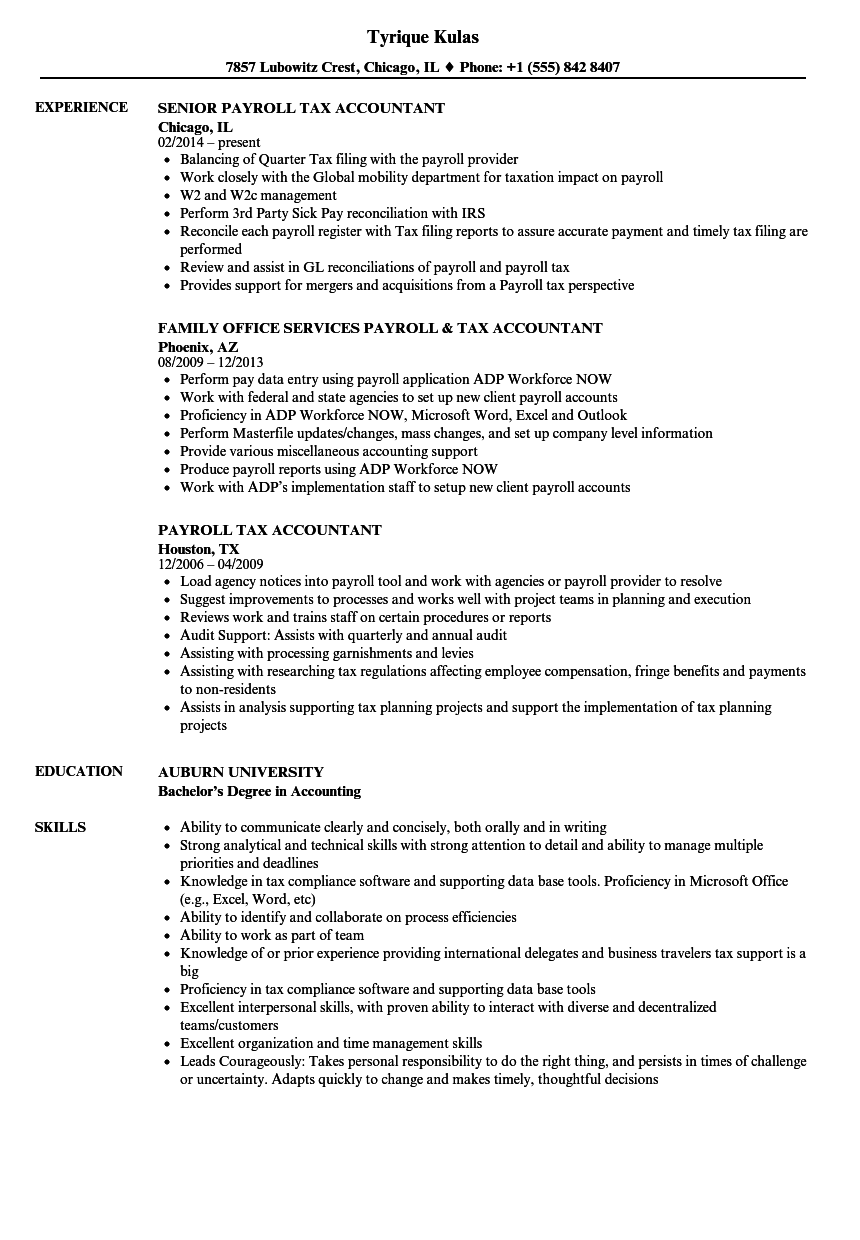

Payroll Tax Accountant Resume Samples Velvet Jobs

Pdf Brochure Of All Our Books Long Version Ilw Com

401k Mistakes Irs Updated 401k Fix It Guide

Cpas May Be Alike Cpa Firms Are Not Tigard Or

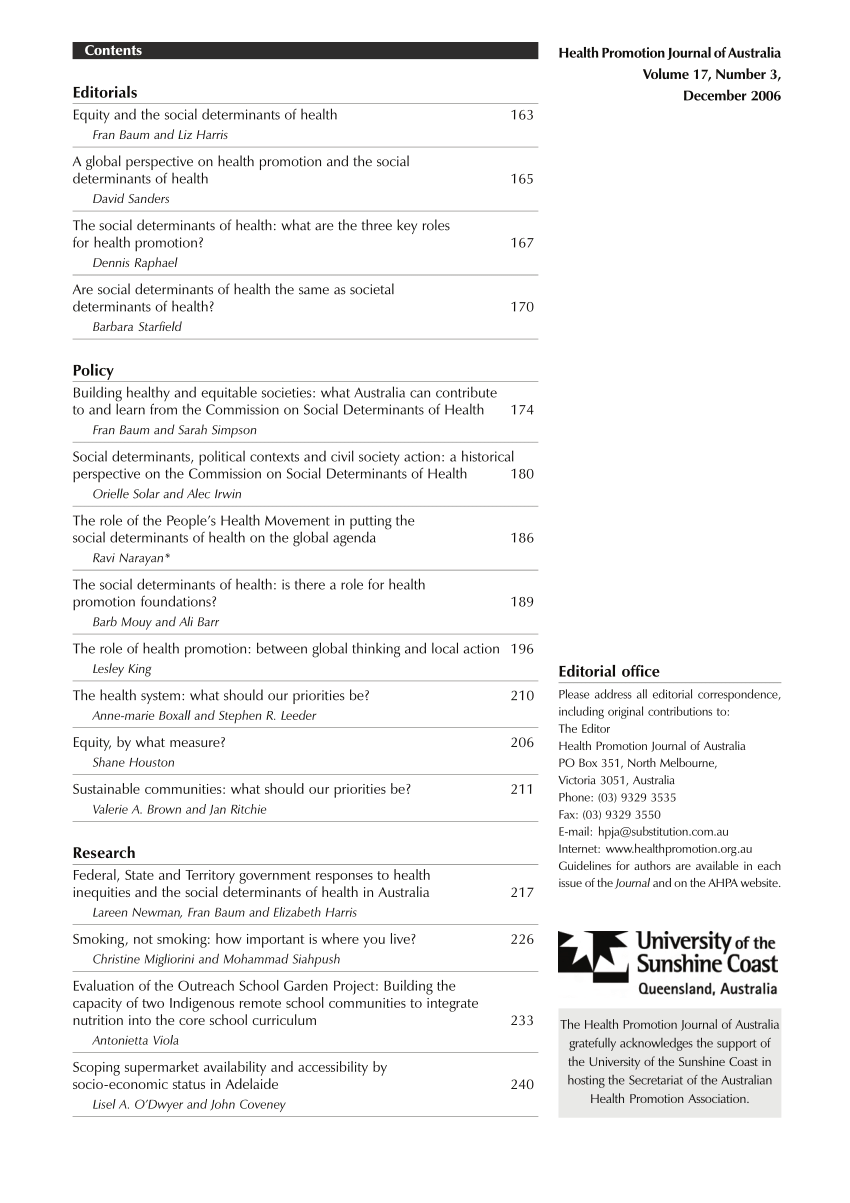

Pdf Social Determinants Of Health And Health Inequalities What Role For General Practice